Insurance companies have deployed a new weapon that’s catching skylight owners completely off guard, and it’s operating right now, photographing your roof from space every single day. Using artificial intelligence to analyze satellite imagery, insurance companies are canceling policies, denying claims, and raising premiums based on skylight-related issues that homeowners don’t even know exist. The letters arrive without warning, giving homeowners thirty days to fix problems they can’t see, remove skylights they just installed, or find new insurance in a market that’s increasingly refusing to cover homes with skylights at any price. What started as a way for insurance companies to assess storm damage without sending adjusters has morphed into an automated surveillance system that’s treating skylights as red flags for cancellation.

The numbers are staggering and getting worse every month. Homeowners with skylights are seeing premium increases averaging forty-two percent over three years, claim denial rates that are triple those of homes without skylights, and in some states, outright refusal of coverage from major insurers who’ve quietly added skylights to their list of disqualifying features alongside wood roofs and knob-and-tube wiring. The insurance industry has discovered that skylights correlate with higher claims, not just for the skylights themselves but for water damage, mold remediation, and even personal injury lawsuits, leading to algorithmic decisions that punish all skylight owners regardless of installation quality or maintenance history. The most infuriating part is that these decisions are being made by computers analyzing images from hundreds of miles up, without any human ever actually inspecting your skylight or understanding your specific situation.

The Satellite Surveillance System Nobody Told You About

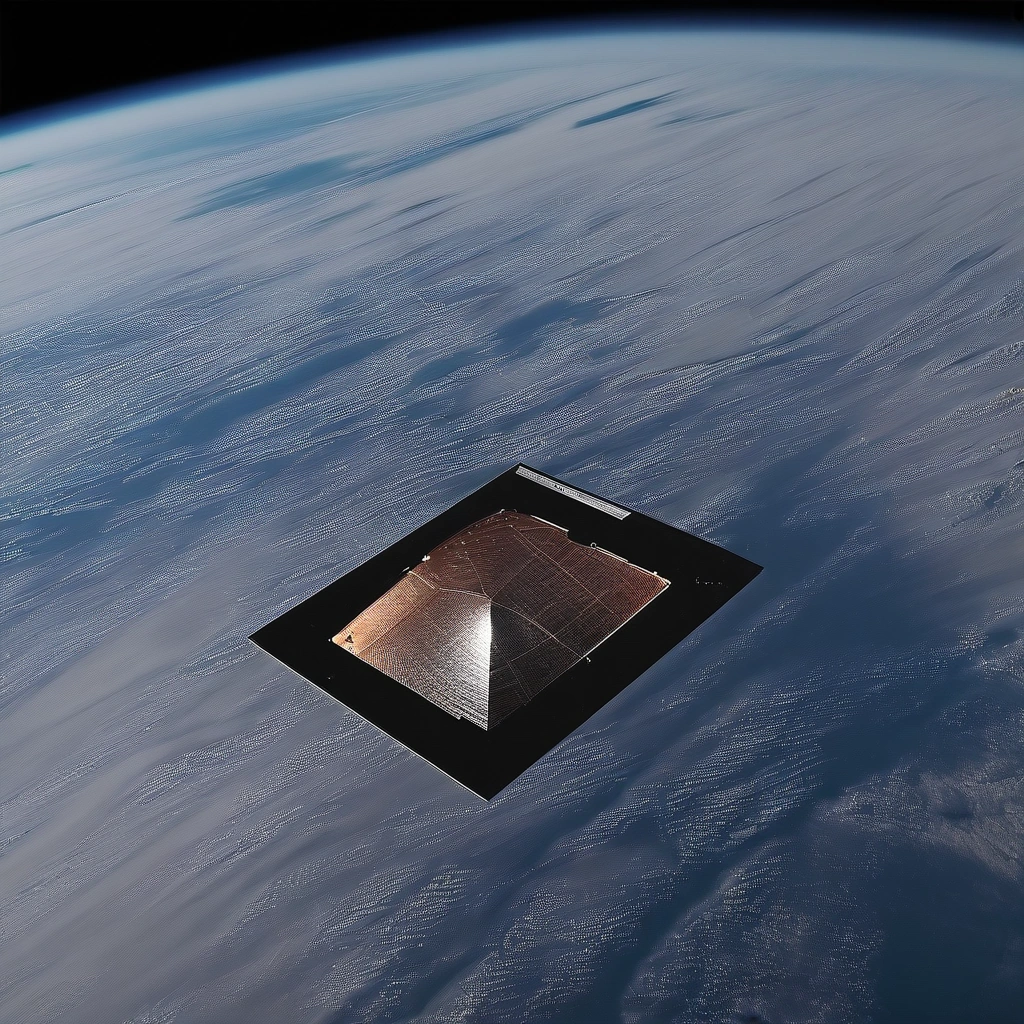

Every major insurance company in America is now subscribing to aerial imaging services that photograph every property in the country multiple times per year, creating a detailed history of your roof that’s analyzed by artificial intelligence systems looking for any excuse to raise your rates or cancel your coverage. Companies like EagleView, Nearmap, and Cape Analytics provide insurers with resolution so detailed they can spot a missing shingle, measure the exact angle of your skylight installation, and even detect the brand and age of your roofing materials from space. The AI systems analyzing these images have been trained on millions of claims to identify correlations between visual features and future losses, and they’ve decided that skylights are massive red flags that predict expensive claims.

What homeowners don’t realize is that these systems are comparing current images to historical ones, flagging any changes for investigation and using those changes as triggers for policy review. That skylight you installed last month isn’t just visible to the satellite; it’s been automatically flagged as a modification that requires underwriting review, potentially triggering a complete reinspection of your property that finds issues unrelated to the skylight but uses the modification as justification for adverse action. The insurance companies love this system because it’s automated, incontestable, and shifts the burden of proof to homeowners who have to somehow demonstrate that what the satellite sees isn’t what the computer thinks it means.

The truly dystopian aspect is that these imaging companies are now offering “predictive risk scores” that estimate the likelihood of future claims based on visual features, and skylights consistently trigger high-risk ratings. The algorithm doesn’t care that your skylight was professionally installed with permits and inspections; it only knows that homes with skylights file water damage claims at three times the rate of homes without them. Some insurers are now requiring quarterly aerial inspections for homes with skylights, essentially putting these properties under constant surveillance and creating opportunities to find reasons for cancellation every three months. The homeowners who thought they were adding value to their homes with skylights are discovering they’ve actually installed insurance company tracking devices that will monitor them forever.

Why Skylight Claims Are Automatically Denied

The dirty secret about skylight-related insurance claims is that most are denied automatically by software before any human adjuster ever reviews them, based on exclusions and conditions that were deliberately written to be impossible to satisfy. The standard homeowner’s policy has been quietly revised over the past decade to include skylight-specific exclusions that make it virtually impossible to successfully claim for skylight-related damage unless you can prove the damage was caused by a covered peril and not by the skylight itself, a circular logic that ensures denial. The adjusters who used to have discretion to approve reasonable claims are now overruled by automated systems that flag skylight claims for denial based on keywords, and any adjuster who overrides these denials faces scrutiny and potential job loss.

The most common denial reason, “improper installation or maintenance,” is particularly insidious because insurance companies define proper installation as exceeding manufacturer specifications, building codes, and industry best practices simultaneously, a standard that virtually no installation meets. They’ll deny your claim because the installer used twenty nails instead of twenty-one, because the flashing extends five inches up the roof instead of six, or because you can’t prove you’ve cleaned the skylight gutters every six months for the entire time you’ve owned the home. The maintenance requirement is especially cruel because most homeowners don’t know skylights require maintenance beyond basic cleaning, and insurance companies deliberately don’t inform them until they’re denying claims based on failure to perform maintenance that was never specified.

The appeals process for denied skylight claims is designed to exhaust homeowners into giving up, requiring documentation that’s often impossible to obtain years after installation, expert opinions that cost thousands of dollars, and multiple rounds of submissions that drag on for months while damage worsens. The insurance companies know that most homeowners will eventually give up or accept lowball settlements rather than fight through the appeals process, and they’ve calculated that the money saved from denied claims far exceeds the occasional successful appeal or bad faith lawsuit. The contractors and skylight manufacturers who know about these denial patterns don’t warn customers because it would kill sales, creating a conspiracy of silence that leaves homeowners discovering the truth only when they desperately need coverage that doesn’t exist.

The Pre-Existing Condition Trap That Ruins Everything

Insurance companies have weaponized the concept of pre-existing conditions to deny virtually any claim involving skylights by arguing that any damage must have existed before the covered event, even when homeowners have clear evidence of sudden damage from storms or accidents. The moment an adjuster sees a skylight, they begin looking for any evidence of pre-existing conditions like minor seal deterioration, slight frame discoloration, or microscopic cracks that they claim must have been present before the loss event. The burden of proof is then shifted to the homeowner to somehow prove that damage visible today didn’t exist yesterday, an impossible standard when insurance companies refuse to accept any evidence except their own inspections that they didn’t conduct until after the damage occurred.

The pre-existing condition trap is particularly effective with skylights because they’re constantly exposed to weather and UV radiation that causes gradual deterioration, giving adjusters unlimited ammunition to claim that any damage was developing over time rather than occurring suddenly. They’ll use thermal imaging to claim they can see evidence of long-term water infiltration even when the leak just started, cite normal weathering as evidence of poor maintenance, and even use the age of the skylight itself as proof that any damage must be from wear and tear rather than covered perils. The sophisticated documentation systems insurance companies now use mean they can pull up satellite images from years ago to claim they can see evidence of problems you never knew existed.

What makes this especially cruel is that insurance companies are now using artificial intelligence to identify potential pre-existing conditions in skylights before claims are even filed, preemptively documenting issues that can be used to deny future claims. They’re sending out inspection notices based on satellite imagery suggesting that skylights show signs of deterioration, creating paper trails that establish pre-existing conditions even when no actual problems exist. Homeowners who receive these notices face an impossible choice: spend thousands on preventive maintenance that might not be necessary, or risk having any future claim denied based on failure to address documented pre-existing conditions. The insurance companies win either way, either collecting premiums while never paying claims or forcing homeowners to spend money maintaining skylights to standards that keep increasing.

The Hidden Skylight Exclusions in Every Policy

Buried in the hundred-plus pages of modern homeowner’s insurance policies are skylight-specific exclusions that most people don’t discover until they’re standing in their living room with water pouring through their skylight and their insurance company explaining why they’re not covered. The standard policy now excludes damage from “design defects,” which insurance companies interpret to mean any skylight that doesn’t perform perfectly in all conditions, regardless of whether the design meets all applicable standards. They exclude “installation errors” even when the installation was done by licensed contractors with permits and passed all inspections. They exclude “gradual deterioration” which they define as any damage that took more than seventy-two hours to occur, even if you couldn’t see it happening.

The most devastating exclusion is for “consequential damage,” meaning that while they might cover the skylight itself if damaged by a covered peril, they won’t cover any damage the skylight causes to your home. So when your skylight leaks and destroys your hardwood floors, furniture, and walls, the insurance company might offer to replace the skylight for two thousand dollars while refusing to cover the thirty thousand in interior damage. They’ve also added exclusions for “improper ventilation around skylights,” “condensation-related damage,” and “damage from ice dams near skylights,” essentially excluding every common way skylights cause problems while maintaining the illusion of coverage.

The insurance companies have become creative in their exclusion language, using terms like “failure to perform as intended” and “breach of warranty” to deny claims even when skylights are damaged by clearly covered perils like falling trees or hail. They’ll argue that if the skylight was supposed to be impact-resistant but wasn’t, that’s a warranty issue not an insurance claim. If it was supposed to be watertight but leaked after storm damage, that’s a performance failure not covered damage. The contractors and skylight salespeople who know about these exclusions don’t explain them because they’re not insurance experts and don’t want to kill sales by suggesting customers read their insurance policies before installing skylights that might eliminate their coverage.

The Rate Increase Algorithm That Targets Skylight Owners

Insurance companies have developed sophisticated pricing algorithms that identify skylights as profit opportunities, systematically raising rates on homes with skylights far beyond any actuarial justification because they know switching insurance is difficult and most homeowners will pay rather than shop around. The algorithms consider not just the presence of skylights but their size, location, age, and even the angle of installation visible in satellite imagery to calculate premium increases designed to extract maximum profit while staying just below the threshold that would trigger shopping for new coverage. These rate increases are carefully timed to coincide with mortgage renewals, tax bills, and other financial pressures when homeowners are least likely to have energy for insurance shopping.

The particularly devious aspect of these algorithms is that they coordinate across insurance companies through shared data services, ensuring that skylight owners face similar rate increases everywhere and can’t escape by switching carriers. The insurance industry shares data through organizations like LexisNexis and Verisk Analytics that track every claim, every policy change, and every property modification, creating profiles that follow homeowners between companies. Once you’re flagged as a skylight owner in these databases, every insurance company knows it and adjusts their pricing accordingly, creating a cartel-like pricing structure that’s technically legal because it’s done through algorithms rather than explicit coordination.

The rate increases accelerate over time using a strategy called “price optimization” where algorithms identify customers unlikely to switch and raise their rates more aggressively than mobile customers. Skylight owners are perfect targets because they’ve invested significant money in their homes and are less likely to be price-sensitive renters who switch insurance regularly. The algorithms have learned that homeowners who install skylights tend to be affluent, established, and busy, exactly the profile least likely to spend time shopping for insurance savings. Some homeowners have seen their premiums double in three years with no claims, purely because algorithms identified them as price-insensitive skylight owners who would pay rather than switch.

The Inspection Scam That Costs Thousands

Insurance companies have created a new revenue stream by requiring expensive specialized inspections for homes with skylights, using their own approved inspectors who charge premium prices and always find problems that require costly remediation to maintain coverage. These aren’t standard home inspections but “skylight certification inspections” that can cost two thousand dollars or more, performed by inspectors who know their future business depends on finding issues that justify the insurance company’s concerns. The inspection reports read like horror stories, identifying theoretical risks, potential future problems, and code violations that don’t actually violate any codes but rather the insurance company’s own made-up standards that exceed building requirements.

The inspectors use tools and techniques designed to find problems, including moisture meters so sensitive they detect humidity from breathing, thermal cameras that show temperature variations presented as evidence of leaks, and digital levels that find slopes invisible to the naked eye but presented as improper installation. They’ll photograph normal caulking and call it deteriorated, measure standard gaps and call them excessive, and document routine weathering as evidence of imminent failure. The reports include dozens of high-resolution photos taken with telephoto lenses that make minor issues look catastrophic, accompanied by technical language that terrifies homeowners into immediate action.

The remediation requirements following these inspections are where the real costs hit, with insurance companies demanding repairs that no reasonable person would consider necessary but are presented as mandatory for continued coverage. They’ll require complete reflashing of functioning skylights, installation of additional drainage systems for skylights that have never leaked, and application of expensive coatings that actually void manufacturer warranties. The approved contractors who perform these remediations charge premium prices knowing homeowners have no choice, and they’re incentivized to find additional issues during the work that require further remediation. Homeowners who refuse these inspections or remediations receive cancellation notices, while those who comply find themselves facing new inspection requirements every few years in an endless cycle of costs.

How to Protect Yourself From the Insurance Skylight Trap

The harsh reality is that homeowners with skylights need to approach insurance like a war where the companies holding your policy are not partners but adversaries looking for any excuse to deny claims and raise rates. The first critical step is documenting everything about your skylights with a paranoia that assumes you’ll need to prove every detail in court, including professional photos from every angle, videos showing water flow during rain, thermal imaging showing no leaks, and monthly logs of maintenance and cleaning. Store these records in multiple locations including cloud storage that’s dated and verifiable, because insurance companies will claim you fabricated evidence if you can’t prove when it was created.

Before installing any skylight, get written confirmation from your insurance company about coverage, rates, and requirements, but know that even written confirmations can be worthless when companies claim representatives exceeded their authority or misunderstood underwriting guidelines. The smart approach is to get quotes from multiple insurers before installation, specifically mentioning the planned skylights, then choosing coverage based on explicit acceptance rather than assumed coverage. Consider creating a legal entity to own your home if skylights make insurance impossible to obtain personally, though this requires careful structuring to avoid triggering commercial rates that are even higher.

The most important protection is maintaining relationships with multiple insurance brokers who can quickly find alternative coverage when your current insurer inevitably tries to cancel or dramatically raise rates. Document every interaction with insurance companies in writing, record phone calls where legally permitted, and never accept verbal assurances about coverage without written confirmation. When problems occur, hire a public adjuster immediately rather than trying to negotiate with insurance companies yourself, as they know the games insurers play and can often get claims approved that homeowners would never succeed with alone. Consider setting aside the money you would spend on skylights into a self-insurance fund instead, as the long-term insurance costs often exceed the value of the skylights themselves.

The future of skylight insurance is only getting worse as climate change increases storm damage, artificial intelligence gets better at finding exclusions, and insurance companies consolidate into fewer options with synchronized pricing. Homeowners who already have skylights need to decide whether the natural light is worth the ongoing insurance battles, while those considering skylights need to understand they’re not just choosing a home improvement but entering a permanent adversarial relationship with their insurance company. The industry that once existed to protect homeowners from catastrophic loss has evolved into a sophisticated system for extracting premiums while avoiding claims, and skylights have become one of their favorite tools for accomplishing both. The choice isn’t whether to have skylights or insurance, but whether you’re prepared for the financial and emotional cost of fighting for coverage you’ve paid for but may never receive.